Recently, the LinaBell toys are becoming sensations across the board. They have been made into memes by countless people because they are cute and adorable. However, LinaBell has also been on top search for the news that the price for it has gone up to over a thousand yuan because of scalpers. Users on second-hand trading platforms even claim to trade Kweichow Moutai for toys of LinaBell.

A few days ago, it was reported that over 6,000 people were lining up outside Disney at 3am only to buy a toy. Fans queuing up overnight just for the Christmas version of a toy is not unusual.

How do collectible toys have so many people head over heels?

The origins of collectible toys could be traced back to Japan and the USA and they have started to be known since mystery boxes became a sensation. Based on the forecasts of many research agencies, the market size of collectible toys in China could be as large as thousands of billion yuan in the next three years.

What kind of business is collectible toys?

And where would it lead the consumer market in the future?

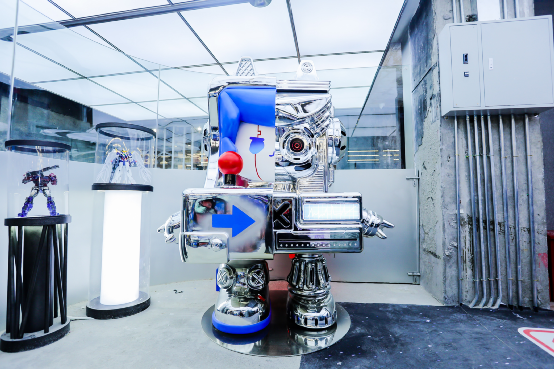

TOP TOY, founded just a year ago, has been a dark-horse candidate in the collectible toy business. It prides itself as a one-stop store for collectible toys from all around the world. Its core products include mystery boxes, building blocks, Gundam pieces, dolls, collectible toys, original creations, etc, with a huge variety of intellectual properties in 9+X categories. Targeting customer groups from 10 to 40 years old, TOP TOY has opened stores in over 40 cities, with a sales volume of nearly 400 million yuan across the board.

This Saturday, Sun Yuanwen, founder and CEO of TOP TOY, will present a class “TOP TOY: Focusing on Experience and Reconstructing the Structure of Collectible Toy Business”. Based on his own case, Sun would take us to understand the nature of the collectible toy business. He would also analyze how a new consumer brand could make itself stand out through redefining scenario and environment of consumption.

Why has collectible toy become so popular in the past year? I’ll explain in 3 levels from a micro, mid-scope and macro perspectives.

People born in the 70s, 80s, 90s, 95s, those born in the 2000s or after 2005 all have hugely different consuming behaviors. People born in the 70s and 90s tend to see e-commerce as a great invention while it’s considered just basic for those born in the 90s.

Generation Z, who were born after 1995, have become the core consumers in China nowadays. According to statistics from various shopping entities, consumptions made by people born between 1995 and 2000 made up to 19% of overall consumptions, larger than that made by any other age groups. It’s followed by consumptions made by people born between 1990 and 2000, making up to 17% - 18% of overall consumption.

Consumers don’t seem to be as crazed by the double-11 online shopping festival this year as they don’t think there’s much special in Tmall in this year’s festival. This could be considered a bottleneck in development for e-commerce.

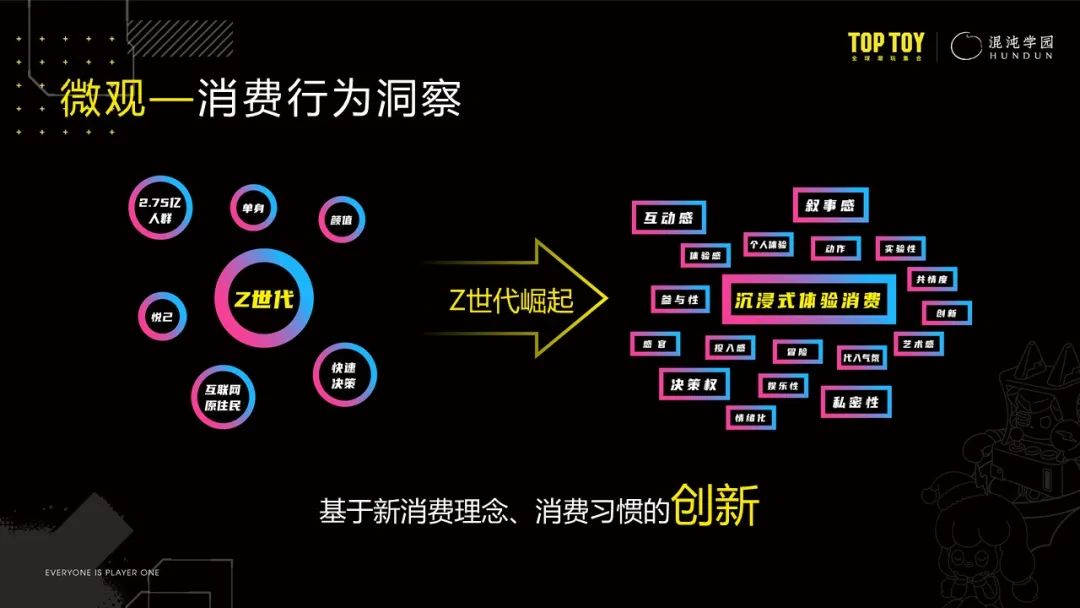

China has a population of around 275 million falling into Generation Z. They’re used to having the internet since they were born, are mostly single and happy to pay for their hobbies. They tend to make quick decisions, love immersion consumption and are willing to spend money they don’t have yet. What they pay more attention to is the experience instead of the efficiency of consumption.

These consumption behaviors lead us to focus on individual consumers and thus facilitating the birth of new brands and new products.

Case: Chi Forest

More and more of the young people in China are aware of their sugar intake and the importance of fitness, while they also love their sparkling water. Chi Forest saw the opportunity in this and rolled out a zero calorie sparkling water, which tastes the same as sparkling water but without the calorie. Consumers are able to enjoy the taste of the drink with no guilt for the calorie intake.

Case: Hunky Fortune Cat

We rolled out the Hunky Fortune Cat and over 3,000 of it were sold out in just a minute. As its name suggests, the Fortune Cat is a symbol for bringing you fortune. The fortune cat with a beefed up arm is a combination of fortune and working out. More and more young people love working out for fitness so they could understand the humor in this unusual version of the fortune cat.

Micro-innovation is small innovation made to adapt to the consuming behaviors of Generation Z based on basic knowledge already obtain by the public. It would quickly bring recognition for new products and such recognition is the base for low-cost promotion.

Case: Miniso

MUJI has what the Chinese people love about Japanese aesthetics, but it also has disadvantages in prices and store locations. Miniso was brought to consumers with fine quality, nice appearances, favorable prices and more stores covering wider regions, thus easily attracting the consumers who are already fans of the MUJI style.

Case: Chinese building blocks

Lego has won a great amount of loyal consumers in the past 10 years. But there are still two issues remaining:

Firstly, it’s the issue of cost performance. The costs of Lego products are low but as a foreign enterprise and a famous brand, Lego would not lower the prices for its products. Meanwhile, with the advantage of supply chain in China, the prices of Chinese building blocks could be 1/3 to even 1/5 of the Lego prices, all while the types, sizes and building experience are of no significant difference.

Secondly, it’s the authorization of Chinese intellectual properties. Lego has the authorization of many world renowned intellectual properties such as Disney and Harry Potter. But there’re also a lot of other IPs that it could not gain authorization while we could, such as the Forbidden City, China Aerospace, China Military, etc.

This is the reason I decided to make Chinese building blocks.

A micro-innovation on something already well-known to the public could lead to unexpectedly strong influence.

From the 1990s to 2010s, collectible toys are like art pieces and everything was extremely expensive in the small market.

There has been a rapid growth of fans of two-dimensional culture from 2010 to 2015. You might all have heard of enthusiastic two-dimensional culture and COSER.

Mystery boxes have been popular since 2016 and gain loyal fans of collectible toys. In terms of aesthetics, promotion and packaging, mystery boxes meet all the requirements from the public’s tastes and the experience.

Collectible toy will become a pan-entertainment for the public in the future, as we could see from 2 phenomena:

Firstly, more and more collectible toys are being put on young people’s desks as they’re a way to show your personality. Naruto Uzumaki on the desk shows that you’re energetic youngster; a sleepy “Long Live Your Majesty” Cat indicates that you’re a chilled individual; a limited edition or a hidden version would not go unnoticed for long. Desk-top “socializing” that costs nothing is a huge potential market.

Secondly, there’s some interior construction going in my house and I asked the designer what the biggest change in interior design was in the past one or two years. He told me that he had been doing interior design for young people, especially those born in the 90s, and they all had one same request: a designated spot for their collectible toys. The market size for interior design is as big as one trillion yuan so one could imagine the market for collectible toys behind that.

We don’t aim to be just a brand for mystery boxes or for building blocks. Instead, we brave to be a brand that gathers collectible toys from different corners, an IP that embraces artists from around the world. We want the matured users to be able to buy art pieces they desire, and we also want to make sure that those new to the business could have access to what they like.

How the national policies favor the infrastructure and industry.

The change in people’s financial strength could be a drive in changing their concepts of consumption. When one’s financial status changes, it’s also change where they want to spend their money.

Change in social environment is also a factor in the change of consumption behaviors.

Technology is an important drive in the stepping up of consumption.

In the USA, Walmart and Carrefour stores are usually in remote areas and people would usually drive to the supermarkets to stock up their fridges with food in the weekends. Without the inventions of cars and fridges, Walmart and Carrefour might not even exist.

Similarly, the inventions of Taobao and Tmall are based on the existence of PC and cellphones. Without cellphone and PC there would not be logistics or express courier service.

All changes in production patterns led by new technology will bring out changes in consumption behaviors.

Why does it take as long as 6 to 8 months to produce a mystery box? Under the current consumption patterns, mystery boxes and garage kits are mostly hand-made. No industrial chain, either semi-automatic or full-automatic, has been in place yet. And manufacturers dare not invest heavily in facilities or technology because there’s no consistent demand in the supply chain.

Therefore, the demands from the consumer would have reverse influence on the production patterns. Cars have become essential and affordable way of transport for regular households and the market is stable and sizable, therefore those at the upstream of the industrial chain are willing to spend hundreds of millions on a production line.

When I was working in a shopping mall in 2013, foreign brands would be on level 1 and level 2 while Chinese brands were scattered here and there on the third and fourth level. Come 2020, I noticed that more and more Chinese brands were showcased at better spots in the shopping malls. I realized that this was an opportunity for domestic brands to take up more market shares or even surpass other international brands.

Consumers will not stay loyal forever and their tastes change. A brand has to constantly challenge and refresh itself to keep up with the consumers’ demands and the consumer market.

What will the future look like? I imagine it’ll be like the Metaverse where the virtual and realistic worlds meet. For example, there’ll be a Hunky Fortune Cat waving next to me while I’m giving this speech.

The business of collectible toys is evolving. This is how new technology could bring changes in consuming patterns, and hence influencing people’s consuming behaviors. We need to understand thoroughly the mentality of the consumers so as to keep up with their demands.

Let’s answer one question first: what is collectible toy? Most people know collectible toy as mystery boxes, garage kits and two-dimensional culture but we need to refresh our understanding. Collectible toy is not just a mystery box or only a Bichon Frisé toy, it’s a concept. We want to build a one-stop collectible toys store with numerous types of items in 9+X categories.

Collectible toy used to be a small market for a minority of people but I believe that we will enter an era in which the general public would be involved with collectible toys in some way and everyone would demand mental and spiritual satisfaction.

The public’s demands and the revolution of information technology have huge impact on retail patterns. We need to use new tools to reshape our stores and meet the demands of the consumers.

In the Chinese market, there’s huge potential in the collectible toy business but there’s not a place for fans to spend on what they love. I want to build a one-stop store with the intention that more and more people could have access to collectible toys.

At the preliminary stage, I had my doubt that it will confuse the consumers if I sell garage kits, mystery boxes, building blocks, etc in the store. They might see the store as a jumble with everything but also nothing.

The movie Ready Player One ridded my doubts. It blended in over 100 IPs in movie, animation, music, and more, and it’s been well received in China. It reassured me that a one-stop collectible toy store could be a great business plan.

And it turned out to be so. Within a short period of time, we made so much great achievements:

On December 18th, 2020, TOP TOY opened its first store in Grandview Mall in Tianhe, Guangzhou. The turnover on the first day was 420,000 yuan.

On January 29th, 2021, TOP TOY launched its app so as to facilitate the online shopping experience in addition to in-store shopping.

On June 1st, 2021, a Collectible Toy Festival was held in Global Harbor, Shanghai. Among over 1000 brands in Global Harbor, TOP TOY topped the list in sales volume by a single store in a single day, with a whopping 1,090,000 yuan.

On June 14th, 2021, TOP TOY participated in the Shanghai WF Trade Show and attracted over 200,000 viewers, ranking No.1 on WeChat Live.

On August 14th, 2021, TOP TOY opened a collectible toy museum in Wenheyou in Shenzhen. The sales volume on the opening day reached over 1 million yuan.

On October 29th, 2021, the first TOP TOY Show was launched, making it the biggest collectible toys exhibition in China in 2021.

The Chinese name of TOP TOY is the same as the Chinese translation of Ready Player One, and I wish for TOP TOY to be a gathering place for collectible toys from all over the world. In the past year, we opened stores in over 40 cities in China, covering over 100 major trading areas and gaining an omni-channel sales volume of nearly 400 million yuan. We sort our products into 9+X categories and each store holds an average of 4,000 SKU. With over 400 cooperative partners, we have extended cooperation with nearly all world-famous collectible toy brands.

When launching a collectible toy brand, one needs to decide on the categories of products to include. After solving the supply chain, there lies one question: do you want to do online-shopping or in-store shopping? Attempting to do both is risky for a new brand and the chance of failing is high.

Reason 1: team experience and my background for offline shopping service

I chose to do offline or in-store shopping for the brand based on the team and my own background. In-store service requires heavy investment while the scale, network and expansion effects are lighter. Online service requires low investment while it costs heavily on marketing for quick sales conversion. Our team has more experience in in-store service and that’s why I made the decision.

Reason 2: analysis on the people-product-place factors

After agreeing that we wanted to be in the shopping mall market instead of community market, we started re-planning our people-product-place module.

People: can we bring in 300 million customers? Can we make sure they don’t turn to other shops? Can we keep up with their changing demands in the future? Can we make these customers loyal to us? The answer is No.

Product: Products are IPs. Can we stop Bandai from going online? Can we be the sole distributor for Bandai’s limited edition products? The answer is also No. We would not be able to gain an overwhelming advantage in a short period of time and we cannot stop our suppliers from providing for others. There’re countless IPs existing and will only be more appearing, which we could not control either.

Place: this is the only factor we have control on. There’re over 3000 shopping malls around China, with over 100 that are large-scaled. We could try to enter the shopping malls within a year and have our experience stores or large stores at the best locations. Normally shopping malls would not bring in another brand similar to the one they already have in same category, which works as a reassurance for us. We could leave a strong first impression when consumers see the TOP TOY products when walk into the shopping mall and walk into our stores. The best 500 shopping malls in China are scarce resources and we should try our hardest to obtain them.

After giving it deliberation, I decided we should start from “place”. We want the best stores in the locations, with the best experience and open as many stores as we could possibly manage.

After opening TOP TOY stores in almost 200 shopping malls in China, negotiating about IPs became a lot easier for us. The business pattern of reallocating people and products with a focus on “place” proved to be working even when we didn’t focus on an insight into the consumers and IPs. Our strategy was to build the “place” first and expand as quickly as possible. More and more shopping malls would realize that they should introduce TOP TOY as well once they notice that high-end malls such as IFS has already done so. Once the “place” is in place, people and products would follow.

Required hours and total hours

In China nowadays, there’s large room for improvement in current operations of shopping malls and physical stores: the wasted opportunities. Shopping malls are usually open for business for 12 hours a day. Around 70% to 80% of the daily turnover was made during the two peak hours while the rest of the time was not utilized fully.

How does this happen?

In managing a store, there are two important concepts: required hours and allocation of hours.

Required hours: assuming a cashier needs one minute to put through a transaction, 1200 minutes is required if there’re 1200 customers on the day. The required hours are 20 hours,

Total hours: the allocation of required hours for multiple staff. For the above-mentioned example, 4 cashiers are required. Each cashier works 12 hours a day, making it 48 hours in total for all of them. With only 20 hours required to serve all customers, it means that 28 working hours were wasted.

There’re around 200 to 300 duties in our store, each with different required hours: it takes an average of 60 seconds to put through one transaction while it takes about 10 minutes to transport one box of products from the warehouse to the store. When we compare required hours and total hours, we realized that there’s a big difference, meaning a lot of the hours were wasted.

During that period of time, the only thing I asked my staff to do was to create demands for the customers. There’re many ways to do this: do an inventory, improve the operation patterns of the store, learn about IPs through digitalized scenarios, talk to customers, or communication with customers on social media if there’s no physical store.

In the past, the only goals for having physical stores were to make customers spend and to meet their essential demands. But nowadays, the most important thing of having a physical store is for customers to have a nice experience. We don’t want to pressure them to spend but to leave them a sound impression. Their experience is more important than their spending.

These are two completely different operation mindsets.

Innovation from TOP TOY: shift of focus from sales per unit area to attracting customers

We have assumptions all the time on people and on how things work. We used to think news is supposed to be delivered to everyone in the same way. That’s why we watch Xinwen Lianbo on CCTV and spend 30 minutes to watch the whole thing only to get 10 minutes’ worth of information we want.

We assume stores are for selling stuff. Staff have to stand in the store for 8 to 10 hours every day while only 3 to 4 of those hours are actually spent serving the brand and the customers. More than half of the working hours are actually wasted.

Meanwhile, Jinri Toutiao (Headline Today) is able to use algorithm to deliver different news to different user groups with different tags based on their interests. Business is able to use the tags to find their target groups for delivering advertisements on their news feeds.

Under the old system, there were assumptions that stores are only for selling stuff and staff are there to work non-stop. And everyone knew that sales per unit area was a key indicator for performance evaluation. TOP TOY wants to break all these assumptions and lay new fundamental assumptions under the new system.

There’re business opportunities in all the assumingly wasted resources. The management is quite immature for new consumer brands and retail brands in China. With the mindset that stores are only for selling stuff, and that what you make equals revenue minus costs, you’re destined to lose money. You must not forget about the inventory costs, depreciation cost and the cost for interior decoration of the stores.

We believe that attracting customers, not just sales, is the key. Sales per unit area should be used as reference index instead of performance evaluation index.

How do we attract customers? We could elongate the service for customers in the store for a sense of delayed gratification. There’s a greater chance customers would spend in a larger store as they would linger for a longer time. It doesn’t matter as much whether the customers make any purchase but it’s more important that they simply stay for longer. We could start two or three thousands of group chats for communications and to provide information on collectible toys.

TOP TOY was inspired by Starbucks in ways of promoting Chinese building blocks to have gusts coming in-store for block building activities. To enhance the customer experience when we open our Lanzhou store, we hosted a series of events such as mystery boxes opening in which citizens could write on the toys that they get with their names and wishes. The store became a Thousand Buddhas Temple for young people where they would bring friends and family and tell them “this is my name here!” It was like a new way of socializing. The consumer would have a good experience and could become our potential customer.

When we broaden the definition for a store, there’s so much room for creativeness and for us to grow.

TOP TOY’s strategies

After confirming the new fundamental assumption, we need to restructure our people-product-place module so as to attract more customers. There are three principles or criteria we should apply:

Case: Grandview Mall Store in Guangzhou

Just 6 months into the operations, our store manager added over 300,000 people on WeChat and any limited editions of toys would be sold out instantly. The team prepared the opening of the store in just 20 days and scored a sales volume of over 400,000 yuan on the opening day alone. The store tops the list of local trends on Dianping.com, with a score of 4.9/5 and over 2000 reviews from users. These are all genuine feedbacks which shows that the store is very well received.

The Grandview Mall store would reserve 1/3 of the best space at the front and by the doors of the store for exhibition. Displayed items would be a monthly rotation of limited versions of art pieces around the world, including toys of Batman, Iron Man, Joker, Naruto, One Piece, etc. Consumers could not help posting pictures of the toys on their groups and WeChat Moments, hence more people would see them. The sculptures of One Piece characters which worth tens of thousands might be too expensive for most but the mystery boxes and garage kits are certainly a lot more affordable. After purchase, the consumers would want to be in the TOP TOY social groups so they could receive information about the next exhibition in a timely manner.

Consumers usually have the desire to share, which is why when they discover an internet-famous store, they would usually visit again, and with their friends. Statistics of the store show that out of all consumers who visit the store twice, 30% of them brought their friends the second time. Because of re-purchase from consumers, the sales volume of the store has not dropped over the course of the year since it was open. During this time, the store manager added over 300,000 WeChat users and kept over 90% of them. Users from hundreds of group chats have checked in at the store, taken pictures and posted on WeChat Moments. Some core users would even write a review on Dianping.com or check in on TikTok or Xiaohongshu. With a closed cycle of consumer interaction, the sales volume is guaranteed.

Ultimate experience

We plan our operations with the goal for our customers to have the ultimate experience. How can we achieve that with the detailed operations? It actually started while customers are lining up to enter the store and the ultimate experience is when they see all the sculptures they’ve never seen before. Customers have to enter the store from one end of the “time tunnel”, follow the one-way passage, and exit from the other end. They would feel amazed after they exit the store as it would feel like they’ve just travelled through time and they haven’t had enough yet.

Every detail and every section is thought through and meticulously designed in the store, from site selection to storefront signboards, visitor flow, shopping consulting, display, to potential check-in points and immersion experience. We give trainings to our staff about the timing when the staff should or shouldn’t be in sight, when to recommend certain products, and when to recommend social. We make sure no working hours goes wasted.

Exhibition is the best way to build an ultimate atmosphere. With relentless efforts from the TOP TOY team, we finally managed to have an exhibition of over 20,000m² at the Canton Fair on October 29th, 2021.

It might look like an exhibition, but in our mind, it was a 20, 000m²store which would be open for 3 days. After breaking the old assumption, we established that stores are not only for selling stuff so we wanted to build a massive store. At the end, over 300 exhibitor from around the world and more than 100,000 people came to our exhibition.

Customers love events such as signing sessions by designers and digital collectible toys, because there’s more chance for interactions. We learnt two things from this exhibition: firstly, consumers would always want to have face-to-face interactions no matter how convenient on-line shopping is; secondly, consumers are always on the pursuit for better experience, and the experience in a 20,000m²store is almost definitely better than that in a 400m²store.

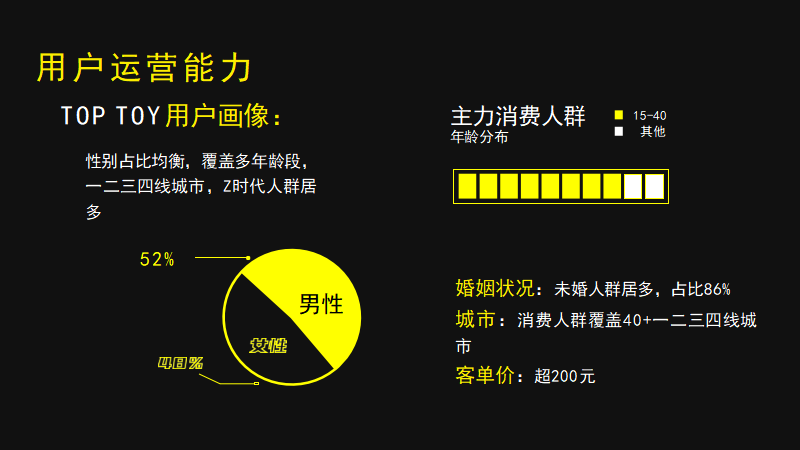

Genders of TOP TOY customers are roughly at a 1:1 ratio while quite evenly spread out in first to fourth tier cities, contrast to another base theory. We always say that young females are the biggest target group for consuming products but have severely underestimated the purchasing capacity from male consumers.

TOP TOY does not only want to have products attracted to only young females. We want to appeal to both young males and young females and even their children. Therefore, we have redefined the “people” factor.

A lot of people born in the 90s have children of their own now, possibly born after 2010. We noticed that over 1/3 of purchases on TOP TOY was made by those under the age of 18. Trendsetters would usually want to buy fashionable toys for their children and this group of children is usually overly neglected in market targeting.

What can TOP TOY do to make customer our focus?

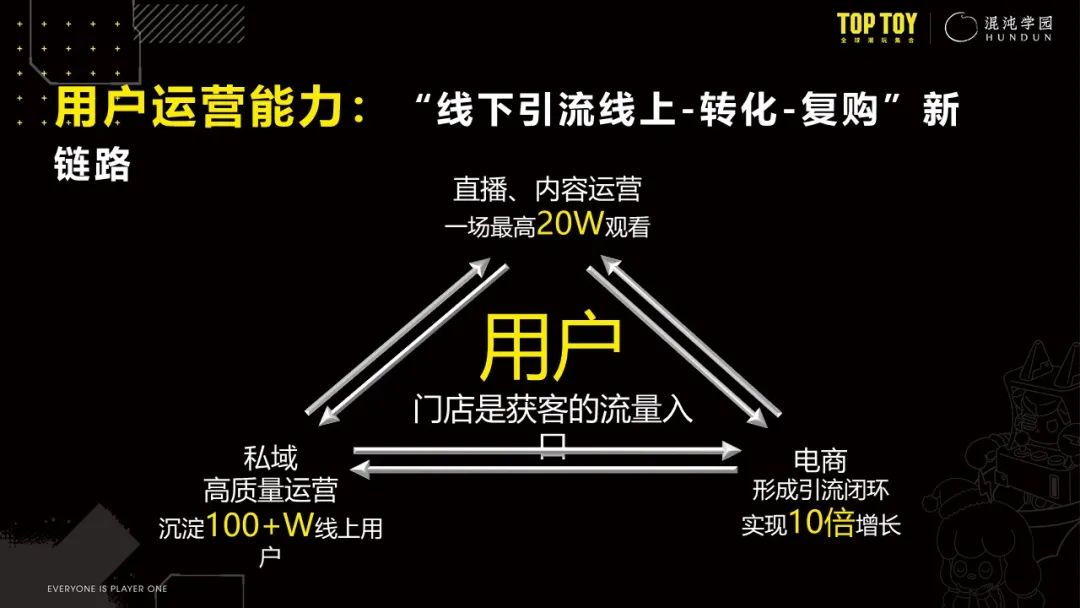

We make live streaming about content operations and we won’t promote our products during such live streaming. For example, during the WF Exhibitions, we did a ten-house live streaming in which we took our users to 5 exhibition halls. A lot of fans were not able to make it to the Exhibition because of Covid-19 restrictions and we saw the opportunity to serve these groups of users. Over 200,000 people flooded into the streaming room and many of them because fans of TOP TOY. The users who know and are loyal to the brands would become core users among consumers.

Over the course of one year, we’re able to gain over 1 million top-quality users. We were able to use e-commerce to gain profits rather quickly. TOP TOY started to be involved in e-commerce and our monthly turnover now is 10 times that of June. We didn’t gain the customers from advertisement or marketing, but from the growth of private groups of fans and users. By directing fans to in-store purchase or on-line shopping, we’ll be able to make the circle go around and achieve the flywheel effect.

Therefore, stores are just one way to attract customers.

There’re two aspects we need to focus on products: firstly, we need to cultivate originality as it stands out and is more controllable, such as the Hunky Fortune Cat; secondly: we need to expand product types.

TOP TOY aims to provide service for different types of users including users who are fans of pan-two-dimensional cultures. Therefore, we need to have products in 9 categories instead of just doing mystery boxes and building blocks. And while we have to cultivate our own IPs and products, we also have to sustain good communication with international IPs and cooperation partners so as to make plans with our close partners. In this way we would be able to build our core competitiveness.

T Universe is an original series by TOP TOY. We live in an era in which all Chinese consumer goods brands in any field or category have a fair chance to build itself into an internationally famous brand. With the growing national strength of China, such brands would almost certainly be able to make their names in the international markets, but it’s utterly important for them to set a firm footing in the domestic market first.

Lego is the monopoly in the building blocks market but we have the customers, stores and supply chains to make a building blocks brand of our own. We could apply micro-innovation and make a building blocks brand with unique Chinese elements.

Lego made a product set with streetscapes of Japan, USA, etc. TOP TOY will to make a series with street views of Tang Dynasty and Song Dynasty, like that in the TV series The Longest Day in Chang’an. It’ll be a great experience for the consumers to be building the beautiful scenery of ancient Tang and Song Dynasties. TOP TOY would also make streetscapes of old Shanghai, as we believe a lot of the consumers in Shanghai still share the memories and nostalgia of those times.

After the scene reconstruction, we summarize a formula for gaining customers: the right scene + the right target group + made in China + unique products other brands don’t have = new Chinese consumer goods brand.

Second half of the collectible toys game: TOP TOY and its friends

What will the second half of the game be like for the collectible toys market? The keys are operating system and amount of inflow. We want TOP TOY to become the Android system in the collectible toys market so we’re trying our best to build the infrastructures. We’re focusing on providing a platform for designs, productions, promotions, sales and IP operations so small to medium IPs and original designs could have more access to users and be turned into actual products more quickly. We believe inclusiveness is key so 70% of our partnered IPs is external – with 70% of the volume for diversity and 30% for exclusiveness.

TOP TOY has and ambition to be the incubation platform for creative Chinese designers. Hunky Fortune Cat, which was a big hit, was designed by artist Xu Zhenbang. Mr. Xu was known in a small crowd with no many followers on Weibo.

But now he has his own line of mystery boxes, toys and super toys. We want our platform to help bring more and better IPs directly to consumers so the designers need not worry about supply chain, marketing or how to make it easier for consumers to purchase. We have it all covered.

When TOP TOY’s market value has been recognized, we built close cooperation with famous Chinese IPs such as Farmer Bob, Rolife and SOOYA. After we opened multiple major stores in key locations, we became the service provider for upstream IP companies and product companies. We chose to build the locations and stores, which is what the famous IPs wouldn’t do but certainly need.

Wenheyou is a whole-package with being an IP itself, combining with its style of decoration and display. It’s not merely a store, but a store with limitless possibilities. Gaining customers is the fundamental “one”, and with the other bonus points as “zeros” following, the potential of the brand could grow 100 times, 1,000 times or even 10,000 times.

After having a strong foothold, it’s easier for TOP TOY to partner up with other brands for cross-overs as the there’ll be high chance of them being hits and gain loyal support from fans. The cross-over with Shenzhen Wenheyou was a successful marketing event. It was not only a creative process with the store, but also a bonding with the fans of Shenzhen Wenheyou.

TOP TOY will observe closely the demands of users and we will continue to have close cooperate and cross-overs with new Chinese consumer goods brand.

打开微信,点击底部的“发现”,使用

“扫一扫”即可将网页分享至朋友圈。